By Kurum

How Do I Know If I Need a Business License?—UAE Guide for Investors

Why This Guide Matters

Setting up a business in the UAE is vastly more accessible today than in many other global markets, thanks to its investor‑friendly reforms, strategic location, modern infrastructure, and open attitude toward foreign investment. Yet, the very first hurdle many face is the question: Do I need a business license? While it may sound like bureaucratic red tape, the business license is your legal gateway to operating smoothly, accessing banking, hiring staff, and building credibility.

This guide — “How Do I Know If I Need a Business License? (UAE Guide for Investors)” — is designed to give you clarity. Whether you’re a freelancer, an e-commerce entrepreneur, or planning a full-blown manufacturing venture, you’ll learn how to assess your need, choose the correct license, navigate the application process, and avoid costly compliance missteps.

What Is a Business License in the UAE?

A business license in the UAE is an official authorization issued by a relevant government authority allowing you to legally conduct your specified business activities. It’s not just a formality—it legitimizes your operations in the eyes of regulators, banks, partners, and customers.

- Mainland (onshore): Licenses are issued by the Department of Economic Development (DED) or equivalent entity in each emirate (e.g., Dubai DED, Abu Dhabi DED).

- Free Zone: Licenses are handled by the respective Free Zone Authority (e.g., DMCC, DAFZA, JAFZA, Dubai Silicon Oasis).

- Offshore: These are issued by offshore registrars (e.g., JAFZA Offshore, RAK ICC) for entities that don’t need physical operations within the UAE.

A license determines what you can legally do: trade goods, provide services, manufacture, run a tourism / hospitality venture, or operate online. Without it, you risk fines, closure, or legal challenges.

Key Players & Jurisdictions: Mainland, Free Zone, Offshore

A crucial factor in determining whether—and which—license you need is your chosen jurisdiction. Each comes with its own rules, benefits, and limitations.

Jurisdiction | Control / Ownership | Market Access | Licensing Authority | Pros / Limitations |

Mainland | You may require a local UAE national partner (though many reforms now allow 100% foreign ownership in some sectors) | Full, unrestricted access to UAE local market | Department of Economic Development (DED) | Pros: broad market access, bidding for govt contracts. Limits: stricter regulation, more approvals. |

Free Zone | Usually 100% foreign ownership | Primarily global and export/import, but limited direct access to mainland without distributor or special permit | Free Zone Authority | Pros: tax benefits, streamlined setup, no customs duties (often). Limits: restricted mainland trade. |

Offshore | No physical operations in UAE | For international business / holding / asset management | Offshore Registrar (e.g., JAFZA Offshore, RAK ICC) | Pros: confidentiality, flexibility. Limits: cannot trade into UAE market directly. |

Your choice of jurisdiction will influence your licensing path, costs, permissible activities, and growth potential.

Why You Might Need a Business License

Here are the primary indicators that you definitely need a business license in the UAE:

- You offer goods or services for profit

Whether through a physical store, an online shop, freelance consulting, or social media-based services—you are conducting business activity and require a license. - You want to register a trade name or brand

To protect your brand, open official bank accounts, and operate under a company name, you must formalize via licensing. - You require banking services, payment systems, or merchant facilities

UAE banks, payment gateways, and merchant service providers typically demand proof of a valid business license. - You intend to hire employees or rent commercial premises

Most labor and lease contracts require a legally licensed business. - You’re a freelancer or solo professional

Even individual processes often need a freelance permit or professional license (especially in certain free zones).

Failing to license when needed exposes you to fines, closure, or legal liabilities.

When You Might Be Exempt (or at Lower Risk)

While these are rare exceptions, you may not need a full business license if:

- You’re engaged in purely voluntary or hobby activities without generating income.

- You’re a remote employee working for a foreign company and not offering services or goods directly in UAE.

- Special regulatory exemptions exist under specific laws (though for business licensing, these are very limited).

However, even with such exceptions, other permits, work authorizations, or No Objection Certificates (NOCs) might apply. Operating any “business‑like” income-generating activity without proper license is generally unwise.

Types of Business Licenses in the UAE

The kind of license you’ll need depends on your business activity:

Commercial License

- For entities engaged in buying, selling, trading, or general commerce.

- Includes import/export, wholesale & retail, real estate brokerage, logistics.

Professional License

- For service providers, experts, and individuals using intellectual or professional skills.

- Examples: consultants, advisors, designers, legal professionals, accountants, freelancers.

Industrial License

- For businesses that manufacture, assemble, produce, or process goods.

- Examples: food processing, textile manufacturing, equipment production.

Tourism / Hospitality License

- For businesses in travel, tourism, events, hotels, guesthouses, travel agencies, event planning.

E‑Commerce / Digital License

- For businesses operating digitally (websites, marketplaces, digital services).

- Licensing must align with trading or service rules, depending on whether you sell goods or deliver services online.

Often, one license may cover multiple related activities—provided you list all permitted activities and get necessary approvals.

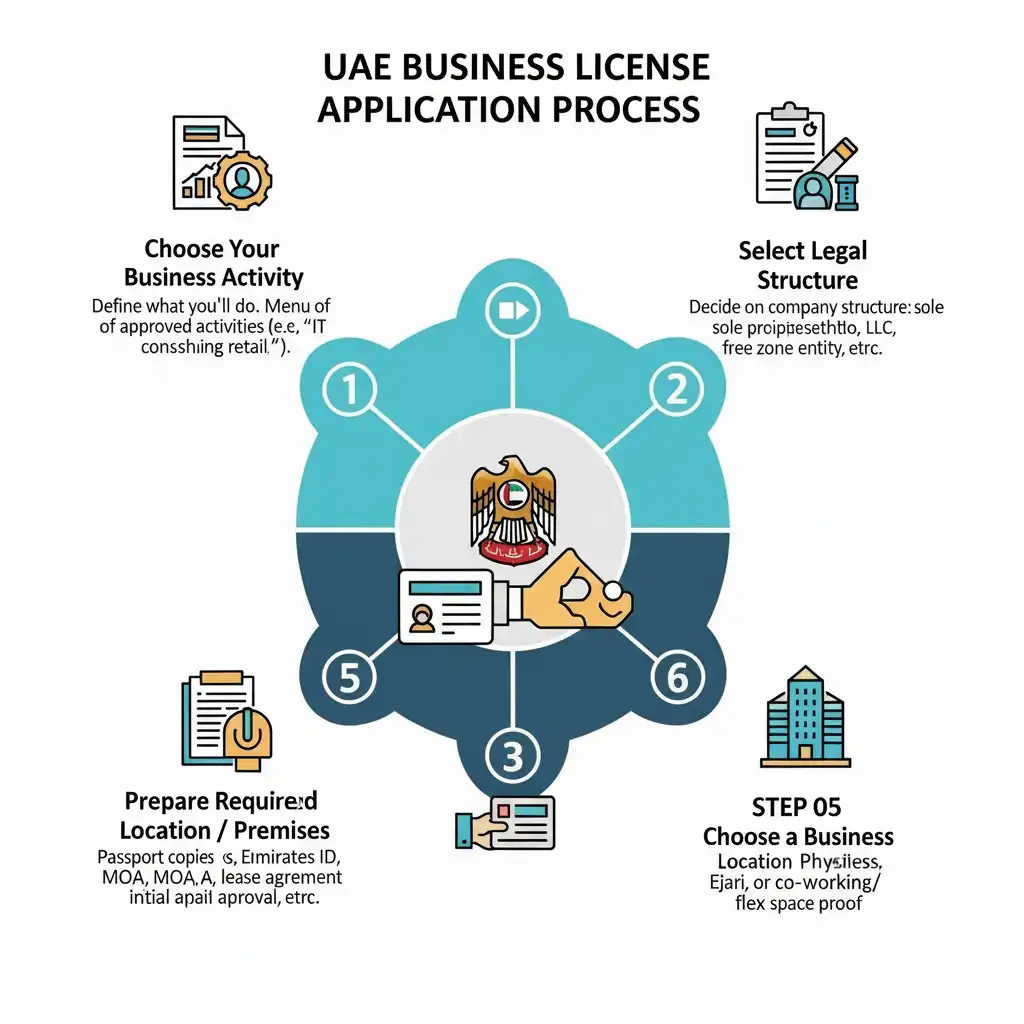

Step‑by‑Step Process to Get a Business License

Here’s a practical roadmap to obtaining your UAE business license:

7.1 Choose Your Business Activity

First, define what you’ll do. Each authority maintains a menu of approved business activities (e.g., “IT consultancy,” “clothing retail,” “food import”).

7.2 Select Legal Structure

Decide on your company structure: sole proprietorship, LLC, civil company, branch, free zone entity, or offshore. Your choice influences ownership, liability, and investor potential.

7.3 Reserve Trade Name & Get Initial Approval

Reserve a unique trade name and get initial approval (often called “no objection certificate”) from the licensing authority. This ensures your name and activity are acceptable.

7.4 Prepare Required Documents

Typical requirements:

- Passport copies of owner(s)

- Emirates ID (if applicable)

- No objection letters (if needed)

- Memorandum of Association (MOA) / Articles

- Lease agreement or tenancy contract (or proof of physical premise)

- Initial approval certificate

7.5 Choose a Business Location / Premises

You must have a physical address (even for many free zones); often a lease contract, “Ejari” or NOC, or proof of co‑working / flex space is required.

7.6 Secure Additional Approvals (if needed)

Certain sectors require special regulatory clearances—for example, food & beverage needs health authority approval, healthcare needs ministry approval, or media enterprises might need NMC clearance.

7.7 Submit Final Application & Pay Fees

Once all documents and approvals are ready, submit your application to the licensing authority and pay the required fees (license issuance, registration, administrative, etc.).

7.8 Receive License & Begin Operations

After processing, your business license is issued. You’re now legally authorized to conduct your specified activities within the UAE jurisdiction.

7.9 Renewal, Amendments & Compliance

Most licenses are valid for one year and must be renewed timely. If your business activities change or you relocate, you may need license amendments.

Costs & Fees (Mainland vs Free Zone vs Offshore)

- Mainland license costs often range between AED 10,000 to AED 30,000 (or more), depending on activity, location, office size, etc.”you can ask the expert“

- Free Zone packages can start from AED 10,000, with higher tiers depending on office, visa quotas, and infrastructure.

- Offshore registration is often more economical but provides no domestic operating rights.

Always check the exact pricing for your chosen jurisdiction, as fees vary widely by emirate, free zone, and activity.

Pitfalls & Common Mistakes to Avoid

- Applying for the wrong activity or license type

- Undervaluing physical address / lease requirements

- Neglecting external regulatory approvals

- Missing renewal deadlines

- Operating outside permitted jurisdiction (e.g., free zone company trying to trade locally without permission)

- Incorrect or incomplete documentation

Careful planning and professional support can prevent these errors.

Practical Examples / Use Cases

Freelancers & Solo Professionals

Many free zones offer freelance permits or professional licenses tailored for individual consultants or creatives.

E-Commerce / Online Shop

You’ll need a trade or commercial license—either in a free zone or mainland—to legally operate an online store and access payment gateways.

Manufacturing / Production

An industrial license is required. This often involves inspection, quality control, environmental clearance, and permits.

Travel / Tours / Events

A tourism license is mandatory. You might also need permits from tourism boards, event permits, or hospitality approvals.

License vs Permits / Additional Approvals

A business license is your foundational authorization. However, depending on your industry, you may need supplementary permits or licenses (e.g., food safety, health, environmental, media, telecom). Always confirm regulatory bodies relevant to your sector.

Legal Risks of Operating Without a License

Operating without a valid license can result in:

- Heavy fines

- Closure or suspension of business

- Seizure of assets

- Inability to renew or register with authorities

- Legal disputes or inability to enforce contracts

It’s far safer to obtain the right license first. (consult the expert)

Tips for Investors & Entrepreneurs

- Consult with local business setup consultants or free zone authorities early

- Clarify your long‑term goals (local trade, export, growth) before picking jurisdiction

- Reserve and protect your trade name early

- Plan for license renewal and scaling (visa quotas, additional activities)

Keep compliance documentation well organized

Frequently Asked Questions (FAQs)

How much does a business license cost in Dubai?

What is the cost for a Dubai mainland license?

What about Free Zone licenses?

Can I start a home business without a license?

Is a license required for an online store (e‑commerce)?

How often must I renew my license?

Do some industries need additional permits?

What if I delay renewing my license?

Can a single license cover multiple activities?

What if my business activity changes later?

Can foreigners wholly own a company in the UAE?

What if I hire staff without a valid license?

Conclusion: Your Next Steps

- Consult with local business setup consultants or free zone authorities early

- Clarify your long‑term goals (local trade, export, growth) before picking jurisdiction

- Reserve and protect your trade name early

- Plan for license renewal and scaling (visa quotas, additional activities)

- Keep compliance documentation well organized